eClosings and eNotes

By: Will Anderson

COVID-19 is catalyzing the residential real estate industry to implement newer technologies as buyers, sellers, agents, lenders, and title agents are forced to socially distance themselves from each other. One of these new technologies is Remote Online Notarization, which we discussed in an earlier blog post. Another technology that has been available, but is now being implemented is the use of eClosings and eNotes.

We expect the use of these technologies to rise in the coming years, but at the time of publication of this blog, we do not expect the industry to shift to a totally digital environment overnight. Instead, we expect a blend of new and old methods prior to a transition to a fully digital environment.

In this blog we will cover:

● What is a note;

● Why a note is critical in a residential real estate transaction that involves buyer financing;

● The transfer of traditional notes, and how transferability impacts eNotes;

● How eClosings operate;

● The “hybrid closing” which combines a traditional and eClosing; and,

● The outlook for these technologies.

A. What Is A Note?

According to the National Association of Realtors, 86% of residential real estate buyers financed the purchase of their home. When a lender provides financing for such a purchase, the buyer agrees to pay the lender back via a contract called a note.

At its core a note is a piece of paper to secure payment. Most people carry around a number of notes in their wallet every day. A U.S. Dollar Bill is a note.

The paper on which a dollar is printed does not have any real intrinsic value. The value from the paper dollar comes from the idea that it can be exchanged for any debts that the person holding it might have, be the debts “public” or “private.” The Federal Reserve secures the dollar paper with tangible and intangible property, such as gold and U.S. Securities.

A note (like the one used in real estate transactions), is defined as a “negotiable instrument,” which means “an unconditional promise to pay a fixed amount of money, with or without interest.” Fla. Stat. 673.1041. Much like a dollar, lenders can exchange the note to a third party; the benefit to the third-party is that the buyer/debtor is now obligated to pay the third-party. We will discuss the transfer of notes later in this article, but the core idea is that whoever is holding the piece of paper on which the note is printed, has the right to collect on the underlying debt.

B. Why A Note Is Critical In A Residential Real Estate Transaction That Involves Buyer Financing.

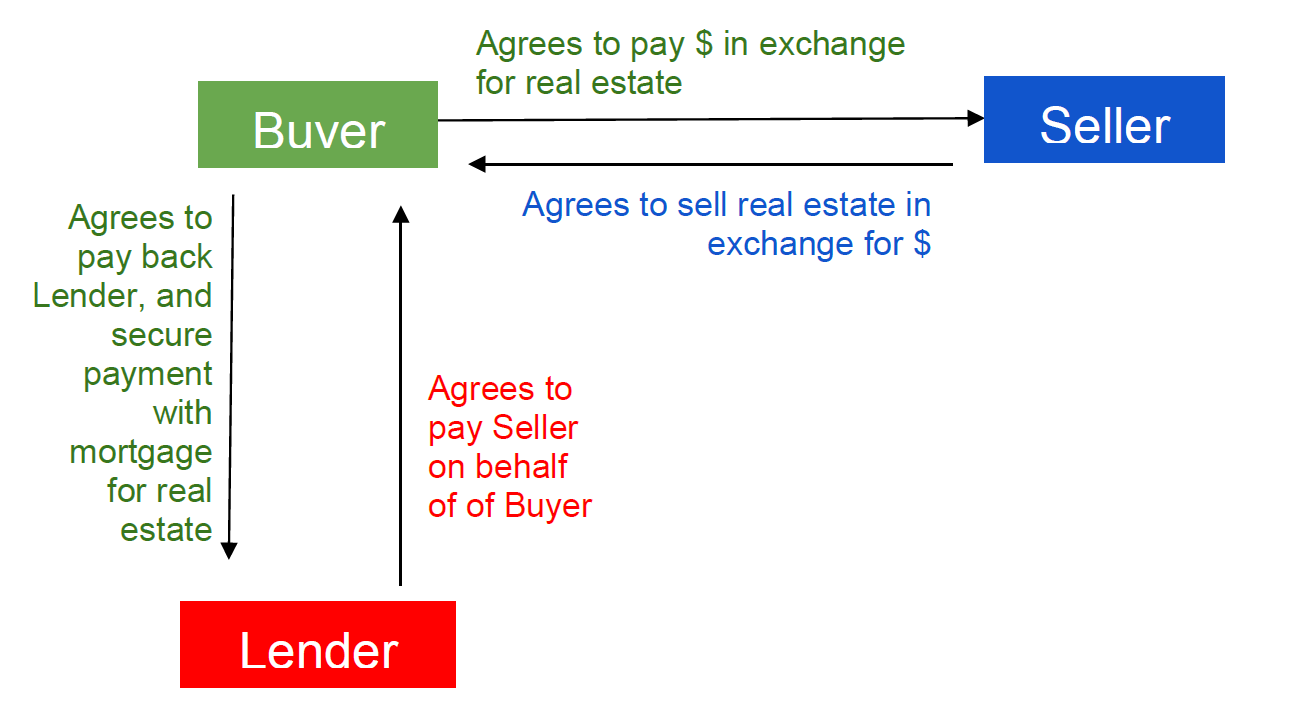

Prior to closing there are a number of agreements that are at play. The below chart gives a visualization of how the various agreements operate between the parties.

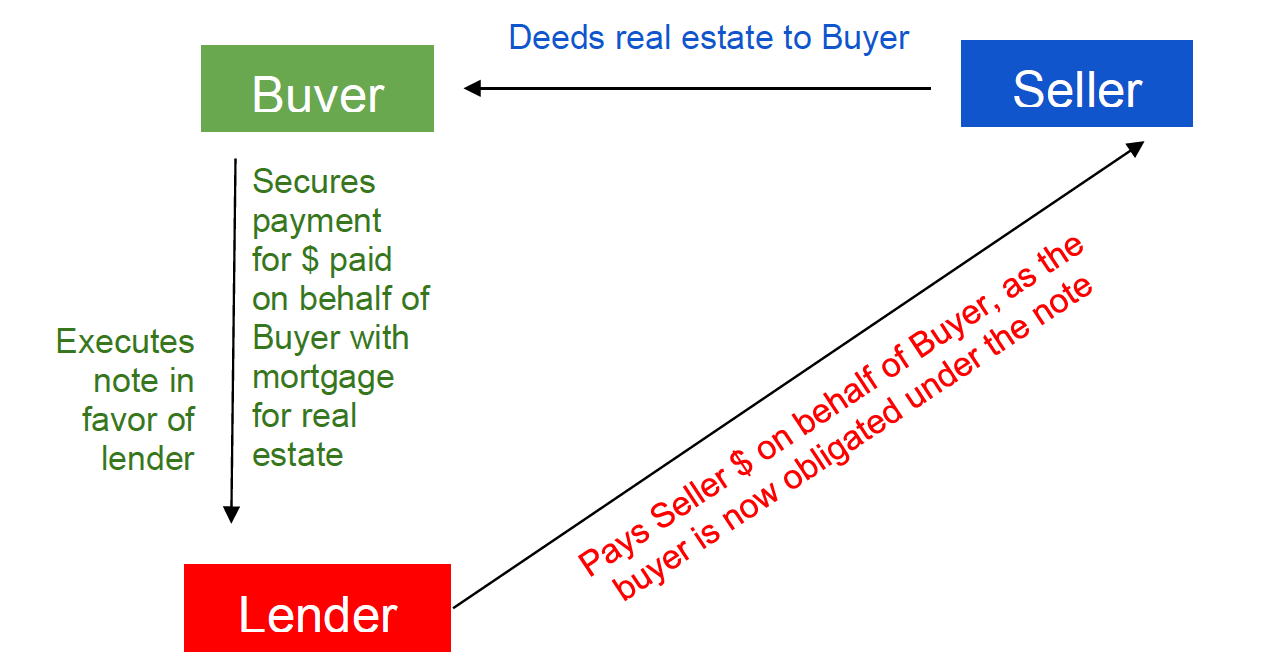

At closing, the buyer, seller, and lender execute on their promises.

If the lender did not pay the seller, on the buyer’s behalf, then the seller would not deed the real estate to the buyer.

In order to make sure that the buyer pays back the lender under the note, the lender requires the buyer to also execute a mortgage in favor of the lender. Only when the buyer is the owner of the property can the buyer execute a mortgage in favor of the lender. See Fla. Stat. § 697.02. The mortgage also “attaches,” to the property, meaning if the buyer transferred the property to another person, dies, et c., the lender would still have the ability to enforce the mortgage against the new owner of the property.

The mortgage is crucial because if the buyer fails to pay the lender under the note for whatever reason, the lender has two choices:

Sue the buyer for the amounts due under the note and then attempt to collect the outstanding amounts due from the buyer personally; or,

Sue the buyer for the amounts due on the note and also seek to foreclose on the mortgage. At the end of the foreclosure proceeding, the lender will request that the court auction the home. The proceeds from the auction will then “make the lender whole” for the amounts due from the buyer/debtor.

If a buyer/debtor is not paying the lender the monthly payments, then generally the buyer/debtor does not have the cash to pay for the amounts due on the note. This is one of the top reasons why lenders require the security in the form of a mortgage from the buyer when the lender provides money to the buyer under the note.

C. What Is An eNote And How Is It Different From A Traditional Note?

As mentioned early, a lender might sell a note after originating the loan. The buyer of the real estate, who was initially obligated to pay back the lender, is now obligated to pay the third-party under the terms of the note.

Obviously, buyers need to be protected from multiple parties claiming that the buyer owes them money. That is why it is crucial that lenders receive a “wet-ink” signature on the note at closing. Copies of the note are sufficient for record keeping purposes, but for enforcement purposes, the original controls. Think of it this way - you can’t photocopy a dollar bill and try to use it to pay for goods and services - you need the original printed by the U.S. Government. If a buyer defaulted on their loan obligations and the lender sought to enforce the note, a lender would be required to present the original “wet-ink” note to a judge in order to collect on the note, or prove that the original was destroyed or lost. Fla. Stat. §§90.953, 90.954.

If a note is executed electronically and stored in only an electronic format, it is easy to see how buyers would not be protected, as there could be multiple files in the hands of multiple parties, each claiming that the buyer owes them money. That is where eNotes steps in - to offer the protections of wet-ink, but in a digital format.

The concept of eNotes is similar to that of BitCoin or other cryptocurrencies. With cryptocurrencies, there is only one copy of the currency, stored in a secured electronic location. Much like cryptocurrency, a set of systems and processes are in place so that only one party is ever capable of claiming ownership of the eNote.

eNotes are a creation of laws passed by state and federal government in the late 1990s and early 2000s. At the federal level, eNotes are governed by the Electronic Signatures in Global and National Commerce Act (“ESIGN Act”), 15 U.S.C. §§7001-31, and in particular are governed by 15 U.S.C. § 7021, “Transferable Records.” Florida, through the Electronic Signature Act, set forth a framework that largely mirrors the ESIGN Act. Fla. Stat. § 668.50. For an eNote to be enforceable under Florida and federal law, the party seeking enforcement must show that the eNote is created, stored, and assigned in a way that ensures the accuracy, reliability, and security that wet-ink paper notes offer.

The hurdles that accompany the construction, maintenance, and use of the software systems that ensure that eNotes are as reliable and enforceable as traditional notes has made the use of the tried and true paper notes the gold standard for lenders (and the investors that notes are sold to) in the twenty plus years since the enactment of the electronic signature laws. However, the potential paradigm shift that may be underway due to COVID-19 (as it relates to eClosing) and technological advances that make such a transaction more cost effective, may lead to more lenders accepting eNotes in lieu of wet-ink.

D. How Does an eClosing Operate?

A “pure” eClosing involves no paper documents, and the parties use electronic signatures to sign digital documents (think for instance, the use of DocuSign, but for the entire closing). Some documents will still require notarization and will need to be completed with the virtual presence of a Remote Online Notary. The parties might “sit” at a virtual closing table, using video-conferencing software that has become the “new normal” in the past several weeks. Lenders and title insurers may promulgate further policies and procedures that ensure the digital environment has the same safeguards that are present in a traditional in office signing.

E. Hybrid Closings Will Likely Rise Before Digital Closings

Although a “pure” eClosing may now be possible under Florida law, thanks in part to the Remote Online Notary laws, we are more likely to see a “hybrid” process in the coming months and years. In the “hybrid” process, the closing packet will contain some documents that are able to be executed and notarized (depending on the document) electronically. The closing packet will also contain some documents that due to lender or title insurer requirements, will need to have a wet-ink signature and the stamp of a notary who witnessed the execution of the documents.

The transition from the traditional to hybrid, and from hybrid to pure eClosing environment will be dictated by the adoption of the technologies by all the parties to a closing; this includes closing agents, title insurers and agents, lenders, buyers, sellers, and real estate agents. Further, there is the need for the development of the industry ecosystem that supports eClosings and eNotes, as the current marketplace is somewhat limited (especially for eNotes) compared to the options present for a traditional closing.

F. Conclusion

The use of technology to facilitate closings will likely continue an upward growth as more and more people become comfortable and familiar with the technology and legal framework surrounding eNotes and eClosings. The critical path to growing these technologies will rely on the adoption and standardization of the process by lenders and title insurers. Further, title, closing, and real estate agents must be willing to adapt to the process and help their clients and customers understand this technology. Mangrove Title and Legal, PLLC is committed to staying current and embracing the evolution of these technologies for the benefit of those we serve.